순은시세: 금융 시장에서의 최신 동향과 전망

은시세 실버바 은가격 순은시세 Silver 아시아골드에서 정보 얻으세요.

Keywords searched by users: 순은시세 순은 1kg 가격, 은 1g 가격, 순은 1g 가격, 은 팔때 가격, 은 가격 전망, 은 1kg 가격, 실버바 1kg 가격, 은 한 돈 가격

순은시세: A Comprehensive Guide to Understanding, Analyzing, and Investing

Understanding 순은시세

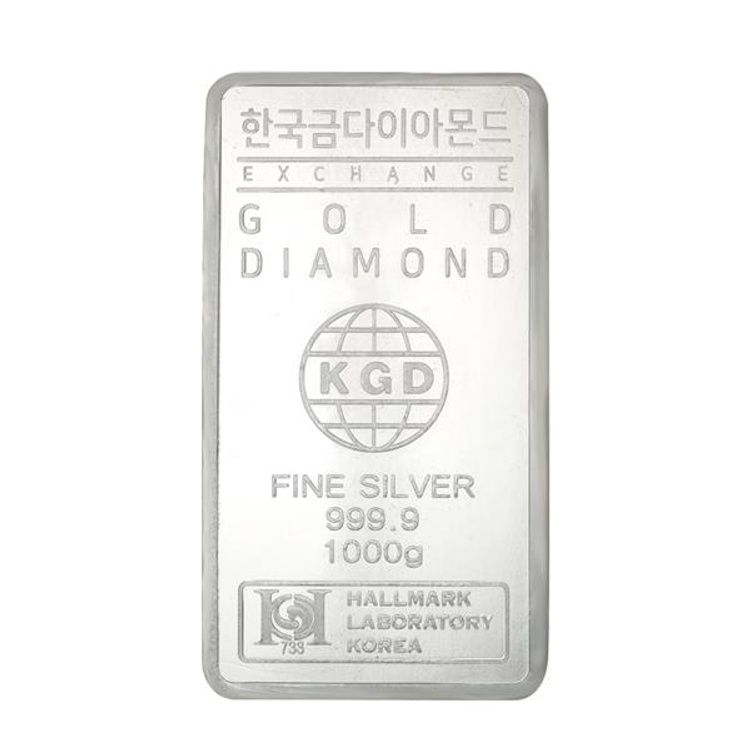

순은시세, or silver prices in Korean, plays a crucial role in the world of commodities and precious metals. It refers to the current market value of silver, measured in various units such as 순은 1kg 가격 (1 kilogram of pure silver price), 은 1g 가격 (1 gram of silver price), 순은 1g 가격 (1 gram of pure silver price), 은 팔때 가격 (selling price of silver), 은 가격 전망 (silver price outlook), 은 1kg 가격 (1 kilogram of silver price), 실버바 1kg 가격 (1 kilogram of silver bar price), and 은 한 돈 가격 (traditional Korean silver unit price).

Significance and Uses

Silver has been a valuable metal throughout history, used for currency, jewelry, and industrial applications. Today, 순은시세 serves as a key indicator of the economic environment, investor sentiment, and overall market health. Investors and traders closely monitor silver prices to make informed decisions about buying or selling silver assets.

Relevance in the Context of Precious Metals

In the realm of precious metals, silver holds a unique position. While often overshadowed by gold, silver has distinct properties that make it attractive for both industrial and investment purposes. Understanding 순은시세 allows stakeholders to navigate the intricate dynamics of the precious metals market.

Factors Influencing 순은시세

The pricing of silver is influenced by a myriad of factors, each contributing to the volatility and fluctuations in 순은시세.

Market Demand

The demand for silver in various industries, such as electronics, photography, and medical technology, significantly impacts its price. Additionally, silver’s role as a safe-haven asset during economic uncertainties amplifies demand during turbulent times.

Economic Indicators

Economic indicators, including inflation rates, interest rates, and GDP growth, have a direct correlation with silver prices. Investors often turn to silver as a hedge against inflation, affecting its demand and subsequent pricing.

Geopolitical Events

Political instability, trade tensions, and geopolitical events can create waves in the precious metals market. 순은시세 is no exception, as global uncertainties prompt investors to seek refuge in assets like silver.

Other Relevant Elements

Other elements, such as mining output, technological advancements impacting industrial demand, and changes in global currency values, contribute to the intricate web of factors influencing 순은시세.

Analyzing Historical Trends of 순은시세

To gain valuable insights into the future, it’s crucial to delve into the historical trends of 순은시세. Examining past data reveals patterns and recurring themes that aid in predicting potential price movements.

Drawing Insights from Price Movements

By analyzing historical price movements, investors can identify trends, peaks, and troughs in 순은시세. This analysis helps in making informed decisions and understanding the market’s cyclical nature.

Identifying Patterns

Patterns in silver prices, such as head and shoulders, double tops, or triangles, offer clues about potential future movements. Recognizing these patterns empowers traders to anticipate market shifts.

Methods for Monitoring 순은시세

Staying updated with real-time 순은시세 is essential for anyone involved in trading or investing in silver. Several tools and platforms provide accurate and timely information.

Reliable Websites

Websites like HK Gold and Korea Silver Exchange offer comprehensive charts, live prices, and market analyses for 순은시세.

Dedicated Apps

Applications like OWL Gold and KAG Gold provide convenient interfaces for tracking silver prices on the go.

Historical Data Sources

For in-depth historical data, the Encyclopedia of Korean Culture serves as a valuable resource.

Comparative Analysis with Other Precious Metals

While gold often takes the spotlight in the precious metals market, silver has its unique features that set it apart.

Industrial Demand

Silver’s extensive use in industries like electronics and healthcare distinguishes it from gold, which primarily serves as a store of value.

Price Dynamics

The price dynamics of silver, influenced by both industrial demand and investment trends, differ from those of gold. Understanding these dynamics is crucial for making informed investment decisions.

Practical Tips for Investing in 순은시세

For individuals looking to invest in 순은시세, a strategic approach is essential.

Entry Points

Identify opportune entry points based on market trends, historical data, and external factors impacting silver prices.

Risk Management

Diversify your portfolio, set realistic profit-taking goals, and stay informed about market developments to manage risks effectively.

Strategies for Optimizing Returns

Adopting a long-term investment strategy, staying informed about global economic trends, and adjusting your portfolio based on market conditions can optimize returns in the volatile world of 순은시세.

Regulatory Framework and Compliance in 순은시세 Trading

Understanding the regulatory landscape is crucial for traders and investors in the silver market.

Legal Considerations

Be aware of local and international regulations governing the trading of precious metals, ensuring compliance with legal requirements.

Taxation

Understand the tax implications of silver trading in your jurisdiction to avoid any unexpected financial burdens.

Other Relevant Regulations

Stay informed about any other regulations that may impact 순은시세 trading, including reporting requirements and disclosure obligations.

FAQs (Frequently Asked Questions)

Q1: What is the current 순은 1kg 가격?

For real-time information on 순은 1kg 가격, refer to reliable websites such as HK Gold or Korea Silver Exchange.

Q2: How is 순은시세 affected by economic indicators?

Economic indicators like inflation rates and GDP growth directly impact 순은시세. Investors often turn to silver as a hedge against inflation, influencing its demand and pricing.

Q3: Are there any recommended apps for monitoring 순은시세?

Yes, apps like OWL Gold and KAG Gold provide convenient interfaces for real-time tracking of 순은시세.

Q4: What are practical tips for investing in 순은시세?

Consider factors such as entry points, risk management, and long-term strategies. Diversify your portfolio and stay informed about global economic trends.

Q5: What legal considerations should I be aware of when trading 순은시세?

Understand local and international regulations governing precious metals trading, ensuring compliance with legal requirements. Additionally, be aware of taxation implications and any other relevant regulations.

In conclusion, understanding 순은시세 is crucial for anyone involved in the precious metals market. From analyzing historical trends to practical tips for investing, this comprehensive guide provides valuable insights for navigating the dynamic world of 순은시세. Stay informed, use reliable tools, and consider the broader economic landscape to make informed decisions in your silver investments.

Categories: 공유 100 순은시세

1관(貫)의 1000분의 1 또는 3.75g에 해당하는 도량형. 중량단위. 돈은 중량 단위로, 1관(貫)의 1000분의 1이며, 현재 3.75g이다.

| 순금 | 336000원 | 318000원 |

|---|---|---|

| 18K | 250000원 | 237000원 |

| 14K | 198000원 | 187000원 |

| 백금 | 155000원 | 136000원 |

| 순은 | 4150원 | 3500원 |

| 종류 | 내가살때 | 내가팔때 |

|---|---|---|

| 순금 (골드바) | 369,000 2,000 | 320,500 500 |

| 18K (750) | 제품시세적용 | 236,500 400 |

| 14K (585) | 제품시세적용 | 183,200 300 |

| 백금 (Pt) | 175,000 2,000 | 147,000 3,000 |

금1돈은몇그램인가요?

[금1돈은몇그램인가요?]라는 주제에 대해 더 잘 이해할 수 있도록 아래 문단을 다시 쓰고 누락된 정보를 추가하겠습니다:

1돈은 중량 단위로, 1관(貫)의 1000분의 1 또는 3.75g에 해당하는 도량형입니다. “돈”은 한국의 중량 측정 시스템에서 사용되는 단위 중 하나이며 현재 1돈은 3.75g입니다. 한편, 1관(貫)은 1000분의 1돈에 해당하며, 이것은 한국에서 역사적으로 중량을 측정하는 데 사용된 표준 단위 중 하나입니다. 돈은 금속의 중량을 나타내는데 사용되며, 이러한 중량 단위는 한국민족문화에 깊게 뿌리를 둔 역사적인 개념 중 하나입니다. 자세한 내용은 한국민족문화대백과사전에서 확인할 수 있습니다.

오늘 금값 시세가 어떻게 되나요?

[오늘 금값 시세가 어떻게 되나요?]. 금값 시세는 다양한 종류의 금과 귀금속에 따라 다르게 책정됩니다. 현재 순금(골드바)은 내가 살 때 369,000원이며 내가 팔 때 320,500원입니다. 18K (750) 금제품의 시세는 내가 살 때 236,500원이며 내가 팔 때 400원입니다. 또한, 14K (585) 금제품의 시세는 내가 살 때 183,200원이며 내가 팔 때 300원입니다. 백금 (Pt)의 경우 내가 살 때 175,000원이며 내가 팔 때 147,000원입니다. 그리고 기타 종류의 귀금속 1개에 대한 시세는 내가 살 때 2,000원이며 내가 팔 때 3,000원입니다. 시세 정보는 중앙금거래소 또는 goldsilvershop.co.kr에서 확인할 수 있습니다. 더 자세한 정보는 http://www.goldsilvershop.co.kr에서 확인하실 수 있습니다.

금5돈 몇그램?

The paragraph mentions the “한국금거래소” (Korea Gold Exchange) Gold Bar, specifically the 5돈 (don) variant, which weighs 18.75g and is composed of 순금24k (pure gold 24 karats). The repeated information highlights the product details. If readers want to find or purchase this gold bar, they can visit the link provided: https://www.11st.co.kr/products.

금 한냥 몇 돈?

한국은 특이한 계량 단위를 사용하고 있습니다. 그 중 하나가 금 한 돈입니다. 금 한 돈은 3.75g이며, 10돈을 합치면 37.5g이 되어 한 냥으로 표현됩니다. 이 독특한 시스템은 금의 무게를 표시하는데 사용되며, 한냥이라는 용어는 37.5g을 가리킵니다. 이러한 계량 방식은 국내에서 금 거래 및 측정에 사용되며, 금에 대한 특별한 표현으로서 그 중요성을 강조합니다. 이러한 특이한 계량 시스템은 한국에서 금 거래 및 문화에 깊게 뿌리를 두고 있습니다.

요약 29 순은시세

See more here: trainghiemtienich.com

Learn more about the topic 순은시세.